In the race to draw firms on the lookout for alternative locations within the wake of the US-China trade war, Vietnam has numerous benefits over its rivals.

Vietnam has been ranked first amongst seven developing Asian countries as a producing location by Natixis SA, after bearing in mind demographics, wages and electricity costs, business and logistics rankings, and the manufacturing industry’s share of total foreign direct investment.

“Vietnam is poised to take some of China’s share of the global labor-intensive manufacturing market,” said Trinh Nguyen, a senior economist at Natixis in Hong Kong. “It’s the clear winner of the trade war.”

Prime Minister Nguyen Xuan Phuc has seized on trade tensions to bolster the country’s position as a producing and export powerhouse, selling every little thing from shoes to smartphones. Trade accounts for about twice its gross domestic product—greater than every other country in Asia except Singapore.

Here’s what makes Vietnam attractive to foreign investors:

Cheap

Vietnamese manufacturing employees earn a mean of $216 a month, lower than half of what their counterparts in China make. Government subsidies also make electricity cheaper, at 7 U.S. cents a kilowatt-hour, compared with 10 cents in Indonesia and 19 cents within the Philippines, in response to GlobalPetrolPrices.com in June.

Vietnam also has certainly one of the biggest labor forces in Southeast Asia, at 57.5 million. That compares with 15.4 million in Malaysia and 44.6 million within the Philippines, in response to the World Bank.

Offers, Investments

Vietnam’s communist leaders have sought free trade agreements with South Korea and Europe, and in March they joined 10 other nations in signing the Trans-Pacific Trade Agreement.

Officials struck a trade cope with the EU in June that may eliminate just about all tariffs. In Southeast Asia, only Singapore has an identical agreement with the EU.

The government also desires to make it easier for foreign investors to do business by proposing a securities law that might allow one hundred pc foreign ownership of public firms, aside from those operating in restricted sectors similar to banking and telecommunications.

Geography

Vietnam’s proximity to China also adds to its appeal. The two countries share a land border, in comparison with countries like Indonesia, the Philippines and Malaysia, that are much further away.

Chinese firms that need raw materials or product components from the United States can have a neater time sourcing those goods through Vietnam. Vietnam is China’s largest trading partner in Southeast Asia, as each nations turn out to be more central to one another’s production chains.

Stability

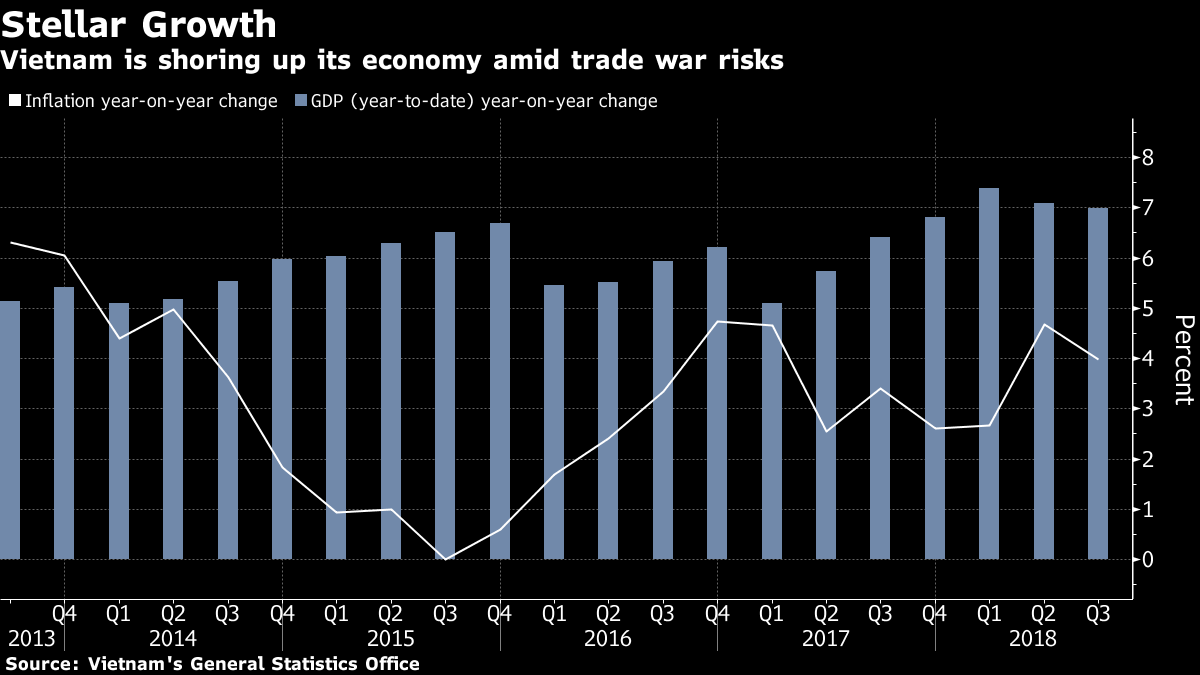

Vietnam boasts certainly one of the world’s fastest-growing economies, forecast to grow by about 7 percent this yr. The dong was relatively stable in 2018 compared with other currencies in Asia, similar to the rupee and the rupiah, which saw big declines.

“Strong economic growth and political stability are very important to investors,” said Tony Foster, managing partner of law firm Freshfields Bruckhaus Deringer LLP, based in Hanoi, Vietnam.

The dong is anticipated to stay fairly stable within the near term, Fitch Solutions Macro Research, a part of Fitch Group, said in October, citing support from strong inflows of foreign direct investment (FDI) and the manufacturing sector.

Source :Bloomberg